There is only one thing worse than a surprise trip to the emergency room or to the psychiatric ward at a hospital—the surprise medical bill that arrives at your house afterward.

41% of U.S. adults are currently living with medical debt.

Earlier this year, U.S. lawmakers enacted new legislation that aims to make this less of a problem.

It’s called the “No Surprises Act.”

How many Americans struggle with medical debt?

Medical debt is a widespread and serious issue in America.

Earlier this year, U.S. lawmakers enacted legislation that aims to make this less of a problem.

As of 2020, 100 million Americans (41% of U.S. adults) are living with medical debt.

If you ever wonder why it’s essential to vote for lawmakers—such as members of U.S. Congress and Senate—this new law is a concrete example of how lawmakers' actions in passing key legislation can have a significant impact on the lives of all Americans.

The “No Surprises Act” protects patients from unexpected bills.

It’s good practice to regularly write letters, send emails, and call your representatives in Congress and the Senate to tell them the types of laws and consumer protections that matter to you.

When did the No Surprises Act go into effect?

The “No Surprises Act” went into effect on January 1, 2022 to protect patients from certain medical billing practices that resulted in unexpected bills.

This new legislation—enforced by the U.S. Department of Labor—is meant to shield patients from receiving surprise medical bills.

In stark contrast to the fun kind of surprises we might want to receive in the mail, these surprise medical bills occur when out-of-network services are provided in an emergency room or at an in-network facility without notifying the patient.

If you do end up receiving a surprise medical bill, what are your rights, and how do you fight it?

According to the American Psychological Association (APA), the Good Faith Estimate provision of the No Surprises Act requires therapists, psychologists, and other mental health care providers to give uninsured and self-paying patients and clients a good faith estimate of costs for services they offer before starting treatment, when scheduling care, or when the patient requests an estimate of the cost of the service.

This provision is designed to give consumers predictability in how much they will be charged and need to pay for the healthcare services they will be receiving, prior to their appointment.

You may be wondering what, exactly, is considered an unexpected medical bill or a surprise bill?

Also, if you do end up receiving a surprise medical or mental health bill in the mail, what are your rights, and how do you fight it?

Read on for more details on this law, why it’s important, who is covered, and how you can fight unexpected medical bills that may still come your way.

What causes surprise medical bills?

When you receive any type of treatment at the doctor's office, the hospital emergency room, urgent care, or a psychiatric ward at the hospital, you likely anticipate some type of medical bill.

But what about when those bills arrive at your house and they’re for much more money than what you anticipated paying? And maybe the bills are more money than you have in your bank account?

According to a 2017 study, surprise medical bills happen about 1 in every 5 emergency room visits, as well as in 9-16% of in-network hospitalizations for non-emergency care.

With 61% of Americans currently living paycheck-to-paycheck, receiving an unexpected medical bill could plunge them into unforgiving debt.

Unexpected medical bills, or surprise bills, typically occur as the result of balance billing.

According to the Journal of the American Medical Association (JAMA), balance billing is billing that occurs when an out-of-network clinician is reimbursed for less money by the insurance plan than they charge for the service the patient received.

When the insurance plan does not pay the clinician the full amount in reimbursement for the service, consequently, the clinician sends the patient a “balance bill”’ to make up the difference and receive the amount the insurance company did not provide.

Why the No Surprises Act was needed

According to a recent survey from Lending Tree, two-thirds of Americans (about 61%), were living paycheck-to-paycheck as of December 2021.

As you can imagine, receiving a surprise medical bill could plunge them into unforgiving debt.

Thankfully, with legislation like the No Surprises Act now in place, American consumers are less likely to be overwhelmed by unexpected medical debt resulting from emergencies and other medical and mental health care.

Judy, a Wisconsin woman who asks that we only use her first name, had an experience with receiving surprise medical bills after a hospital visit in 2019 before the No Surprises Act went into effect.

According to the Kaiser Family Foundation, about 1 in 5 emergency room visits will result in a surprise medical bill.

“I was diagnosed with stage 4 cancer which came about in a very sudden and debilitating way,” she says. “Overnight I was admitted in-patient to the emergency room. Then, I was put on a ventilator and taken by ambulance to a specialty hospital about 25 minutes away.”

According to Judy, her medical bills were astronomical—even with health insurance.

“This No Surprises Act legislation is long overdue and should be talked about more,” Judy explains. “Because most people might just be paying what comes in the mail and drowning in debt for the rest of their lives because of those surprise bills.”

Judy’s experience isn’t an uncommon one.

According to the Kaiser Family Foundation, about 1 in 5 emergency room visits will result in a surprise medical bill.

Additionally, surveys show being able to afford unexpected medical bills is the number one worry among Americans, followed by their health insurance deductible, and their prescription costs.

How does the No Surprises Act affect therapists?

Monarch psychologist Dr. David Helfand, Psy.D., talks about how the No Surprises Act impacted his counseling practice.

“The law is designed to make sure clients know upfront what the likely cost of treatment is going to be and any hidden fees that might come up,” says Dr. Helfand.

He said he understands its importance but finds it to be an unnecessary ruling for private mental health practitioners.

“The law is designed to make sure clients know upfront what the likely cost of treatment is going to be and any hidden fees that might come up,” says Dr. Helfand.

“Almost every mental health provider bills a standard hourly rate, sees clients on a regular basis, and informs them of all fees related to sessions and extra admin time both in writing, on their website, and during the first session or phone call,” he says. “It’s all very transparent in our world.”

Dr. Ben Caldwell, Psy.D, explains more here about what it means for counselors and therapists to abide by the Good Faith Estimate provision of the No Surprises Act.

What are your rights as a patient under the No Surprises Act?

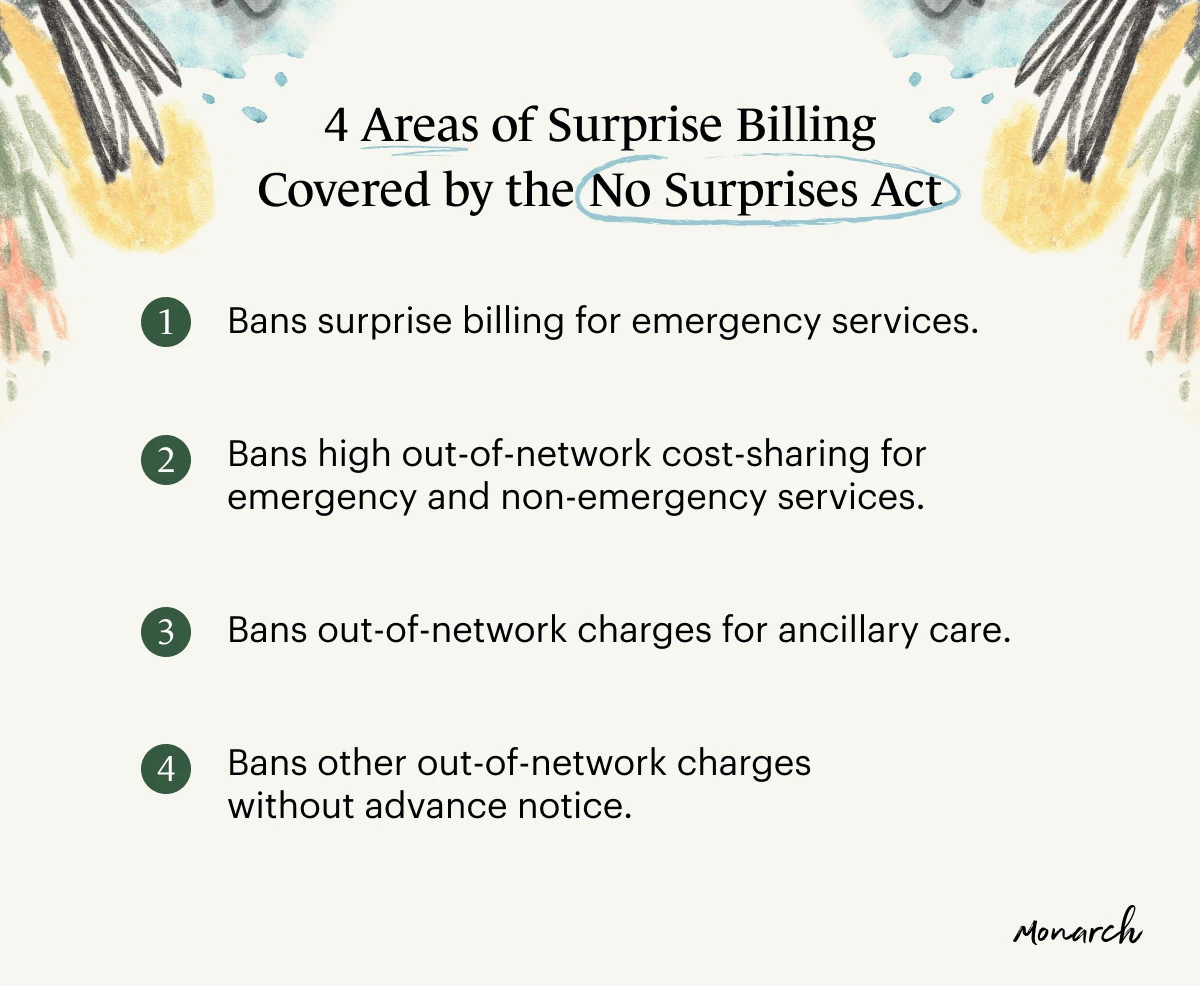

According to the Department of Health and Human Services, this legislation primarily covers four areas of surprise billing.

The No Surprises Act protects consumers by:

Banning surprise billing for emergency services - All emergency services, regardless of location, will be billed at in-network rates.

Banning high out-of-network cost-sharing for emergency and non-emergency services - Patient costs, like co-insurance or deductibles, cannot be higher than the rate they would be billed at from an in-network provider.

Banning out-of-network charges for ancillary care - Ancillary care could include services provided by an anesthesiologist or assistant surgeon at an in-network facility, even if they are technically out of your insurance network.

Banning other out-of-network charges without advance notice -Health care providers have to provide notices that explain what costs they could incur if they opt for services or providers at a higher, out-of-network rate.

For example, if a patient isn’t provided notice or explanation that the care or service they are going to receive (unless it involves emergency care) is part of an out-of-network plan, they cannot bill you at the higher rate.

Likewise, if a patient is given notice and they do not consent, the services should not be provided and would not be billed as such.

How do I fight surprise billing?

Now and again, regardless of the legislation that’s been put in place, it’s possible that you still might receive a surprise bill.

If you find yourself in this situation, there are a few different courses of action you can take.

1. Don’t sign any paperwork you don’t understand

Before you have any type of testing, surgery, or medical services provided, there is always a lot of paperwork.

During the shuffle of all the paperwork and signatures, make sure you understand what you’re agreeing to or opting out of.

Part of the surprise billing act requires providers to give you advanced notice of out-of-network costs.

During the shuffle of all the paperwork and signatures, make sure you understand what you’re agreeing to or opting out of.

So, make sure you are okay with, and understand, what’s being offered to you before signing and acknowledging that you're onboard with it.

If you’re unsure, speak up, ask questions, and ask for an explanation.

2. Call your insurance and the medical provider

Start by giving your insurance provider a call to make sure you understand what services you were billed for and why they were billed at the rate you received.

It’s important to call your insurance and medical provider as soon as possible to avoid missing any deadlines or payment being delayed.

After receiving that information, give the medical provider a call to relay the information. Or, perhaps, try getting on a call with both places at the same time to avoid any miscommunication.

It’s important to call your insurance and medical provider as soon as possible to avoid missing any deadlines or payment being delayed.

Even if you’re worried about the bill going to collections, don’t start paying the bill. By doing so, you’re assuming responsibility.

Also, even if you’re worried about the bill going to collections, don’t start paying the bill. By doing so, you’re assuming responsibility.

3. File an official complaint

If after discussing the matter with both your insurance and medical provider no resolution has been reached, file an official complaint online here or by calling 1-800-985-3059.

How to find affordable therapists and mental health professionals

If you want to find a therapist but have concerns about cost, be sure to explore all the choices available.

Check out the Monarch Directory by SimplePractice to find licensed therapists near you and choose to browse therapists and counselors covered by your insurance.

Each individual therapy provider’s page on Monarch lists their hourly fees directly underneath their areas of specialty.

Many therapists listed on Monarch also allow you to book free 15-minute initial consultation sessions.

Here are also more tips on how to find a therapist covered by your insurance.

READ NEXT: Affordable and Low-cost Therapy Options

Need to find a therapist near you? Check out the Monarch Directory by SimplePractice to find licensed therapists and counselors with availability and online booking.